Ron Baron - A Look At His Investment Approach

Ron Baron, a name many folks in the world of money management know quite well, is a person who has truly made his mark. He is the person who started Baron Capital, an investment firm based right there in New York City. For a good many years now, he has been known for his particular way of looking at where to put money, often focusing on companies that are poised for significant expansion. He is, you know, a mutual fund manager who has built something quite substantial from the ground up.

This firm, Baron Capital, which Ron Baron set up, looks after a rather large sum of money, actually. We are talking about billions of dollars, a truly impressive amount that shows just how much trust people place in his decisions. They are all about finding those businesses that are growing, the ones that seem to be on an upward path, more or less. It is a specific kind of thinking that has, by all accounts, paid off rather handsomely for those who have put their funds with him.

From his early days growing up in Asbury Park, New Jersey, to his current standing as a billionaire investor, Ron Baron's journey is, in some respects, quite fascinating. He has, for example, stuck by some rather bold choices, like his continued belief in certain electric vehicle companies, even when things looked a little shaky. It is that sort of conviction, you know, that often sets people like him apart in the financial world.

Table of Contents

- The Story of Ron Baron

- How Did Ron Baron Begin His Investment Path?

- What Drives Ron Baron's Investment Choices?

- Ron Baron and His View on Big Bets

- How Does Baron Capital Deliver for Investors?

- What Makes Ron Baron's Approach Stand Out?

The Story of Ron Baron

Ron Baron, the person behind a rather well-known investment company, actually started his life in a place called Asbury Park, New Jersey. He was brought up in a family with a Jewish background. His father, Morton Baron, worked as an engineer, someone who built things and made them work. His mother, Marian, looked after the home and the family. It is, you know, a pretty common sort of family setup for the time.

Even when he was just a youngster, Ron showed a real knack for doing his own thing and finding ways to earn a little money. He was not one to sit still, apparently. He took on all sorts of odd jobs, like clearing snow from driveways when winter came around. He also spent time serving food to people in restaurants, waiting on tables. During the warmer months, he would keep an eye on swimmers as a lifeguard, making sure everyone stayed safe. And, of course, he spent some time selling ice cream, which is, you know, a pretty classic summer job for a young person. These early experiences, you could argue, really helped shape the person he would become, instilling in him a sense of drive and a desire to build something for himself.

His academic journey took him to Bucknell University, where he earned a degree in Chemistry back in 1965. That is, you know, a rather different field from managing money. After that, he spent some time at Georgetown University. There, he worked as a teaching fellow, helping others learn about biochemistry. It is interesting to see how his path, initially, was not directly connected to the financial world, which makes his later success in it all the more remarkable, basically.

Personal Details and Bio Data

| Name | Ron Baron |

| Born | Asbury Park, New Jersey |

| Family | Morton Baron (father), Marian Baron (mother) |

| Education | Bucknell University (B.A. Chemistry, 1965), Georgetown University (teaching fellow in biochemistry) |

| Early Ventures | Shoveling snow, waiting tables, lifeguarding, selling ice cream |

How Did Ron Baron Begin His Investment Path?

So, after his time in academia, Ron Baron decided to step into the world of finance, which, you know, was a completely new area for him at that point. He was, by all accounts, quite new to the whole financial industry. He started Baron Capital, his very own investment firm, way back in 1982. This was a significant step, as it meant he was setting out to manage other people's money, a task that requires a good deal of trust and insight. It is, in a way, a testament to his confidence and vision that he took such a big leap.

One thing that really sets Ron Baron apart, and something he adopted early on, was his particular way of looking at the market. He often took a view that went against what most other people were thinking or doing. This is sometimes called a "contrarian" approach, and it means he was willing to bet on things that others might have overlooked or dismissed. It is, you know, a rather bold strategy, but one that has clearly worked well for him over the years. This sort of thinking, of going against the grain, can be risky, but it can also lead to some truly impressive results if you get it right, which he apparently did.

His firm, Baron Capital, has grown quite a bit since those early days, too. From its beginnings, it has managed to gather a rather large sum of money, accumulating over $41 billion in assets since 1982. This shows, you know, a consistent ability to attract and keep investors. The firm focuses on what they call "growth equity investment solutions," which essentially means they look for companies that are expected to expand significantly. It is, in essence, a strategy built on finding the businesses of tomorrow, today.

What Drives Ron Baron's Investment Choices?

When you look at how Ron Baron makes his investment decisions, it becomes pretty clear that he has a very specific kind of focus. He is, you know, always looking for companies that are set to grow a lot. His firm manages about $45 billion, which is a rather large amount of money, and a big part of that is put into businesses that he believes have a bright future. For example, his firm's portfolio, as reported by Bamco Inc.'s 13F filing, recently grew to about $38.69 billion. This portfolio holds positions in 350 different companies, but he puts a lot of emphasis on about 35 key ones. These include well-known names like Tesla, Gartner, Arch Capital, CoStar, and MSCI, so you can see he is looking at a mix of different sectors, basically.

He is known for making significant adjustments to his holdings, too. For instance, in the third quarter, he made some rather important changes to his portfolio. This suggests he is always reviewing and adapting his strategy, rather than just setting it and forgetting it. He is, in some respects, constantly on the lookout for new opportunities or for times when he needs to shift things around. This active management is a hallmark of his approach, ensuring that his investments stay aligned with his vision for growth.

Ron Baron and His View on Big Bets

One of the most talked-about aspects of Ron Baron's investment strategy is his unwavering belief in certain companies, especially those led by people he admires. For instance, he has been very vocal about his support for Tesla, the electric vehicle company. Even when Tesla's stock took a rather significant dip, he made it quite clear that he would not be selling any of his own personal shares. He really praises Elon Musk's vision, seeing him as someone who is pushing boundaries. He also expressed a hope that Musk might be a little less involved in the political scene, particularly with the Trump administration, which is, you know, a rather interesting point of view from an investor.

It is rather interesting to note that while Ron Baron typically leans towards the Democratic party in his political views, when it comes to his money, Elon Musk has, in a way, been his guide. This shows that his investment decisions are based on what he sees as good business opportunities, perhaps even more than his personal political leanings. He really believes in the ideas and the drive of certain leaders, which is, you know, a pretty powerful motivator for his investment choices.

Beyond Tesla, another very big investment for Ron Baron and his firm is SpaceX. This rocket company has seen its value go up quite a bit in 2024, reaching a valuation of $350 billion after a recent sale of some shares. Ron Baron is, you know, very positive about what the future holds for SpaceX. He even has a prediction that this company could be worth as much as $600 billion by the year 2030. That is, in some respects, a truly ambitious forecast, showing just how much faith he has in the company's potential to keep growing and innovating. It is, basically, another example of his willingness to make large, long-term bets on what he sees as transformative businesses.

How Does Baron Capital Deliver for Investors?

Baron Capital, the firm Ron Baron leads, has a long history of working in the financial world, with over 55 years of research experience under its belt. This means they have spent a very long time studying markets and companies, which, you know, gives them a deep understanding of where to put money. They are set up as an asset management firm, and their main goal is to provide investment solutions that focus on companies that are growing. They are, in a way, specialists in finding those businesses that are expanding and becoming more valuable over time.

When you look at how their funds have performed, the numbers are, quite frankly, rather impressive. For example, since they started, 16 out of 19 of Baron's mutual funds have done better than their main comparisons. This represents a very large portion of the money they manage, about 96.4% of their assets under management. This track record suggests a consistent ability to pick winners and manage them well. The Baron Partners Fund, in particular, had a very good third quarter, gaining 13.94% on its institutional shares. This result, you know, significantly beat what its benchmark achieved, which is a good sign for those invested in it.

It is important for anyone considering putting their money with Baron Capital, or any investment firm for that matter, to understand a few key things. Their investments are not insured by the FDIC, which is a government agency that protects bank deposits. This means that, unlike money in a savings account, there is a possibility that you could lose some or all of the money you put in. Also, these investments are not guaranteed by a bank. This is, you know, pretty standard for mutual funds and other investment products, but it is a point that always needs to be made clear to potential investors. They are an investment adviser registered with the U.S. Securities and Exchange Commission, which means they operate under specific rules designed to protect investors.

What Makes Ron Baron's Approach Stand Out?

What really sets Ron Baron apart, and what makes his approach to investing rather distinct, is his deep focus on growth companies and his willingness to stick with them for the long haul. He is, you know, a very seasoned investor, someone who has seen many market ups and downs. His firm, Baron Capital Management, is known for this particular emphasis. Insights from their latest 13F filings, which are public reports of their holdings, always give people a good look at where he is putting his money and why he might be making certain moves. It is, basically, a window into his thinking and his firm's strategy.

Ron Baron is also someone who frequently shares his thoughts on the market and specific companies with a wider audience. He often appears on financial news programs, like CNBC's 'Squawk Box'. During these appearances, he discusses a whole range of topics, from the latest market trends to the performance of companies like Tesla. He also talks about the leadership of people like Elon Musk and even gives his thoughts on the state of companies like SpaceX. These discussions provide, you know, a valuable insight into his perspective and how he views the broader economic landscape. He is, in some respects, quite open about his views, which is something many people appreciate.

His firm's success, with many of their funds outperforming their benchmarks, really speaks to the effectiveness of his long-term, growth-oriented strategy. It is not just about picking a few winners, but about having a consistent method that delivers results over many years. He is, in a way, a testament to the idea that patience and a clear vision can lead to significant financial achievements. This consistent performance, coupled with his public discussions, has helped build his reputation as a thoughtful and successful money manager.

Ron Paul | Biography, Education, Books, & Facts | Britannica

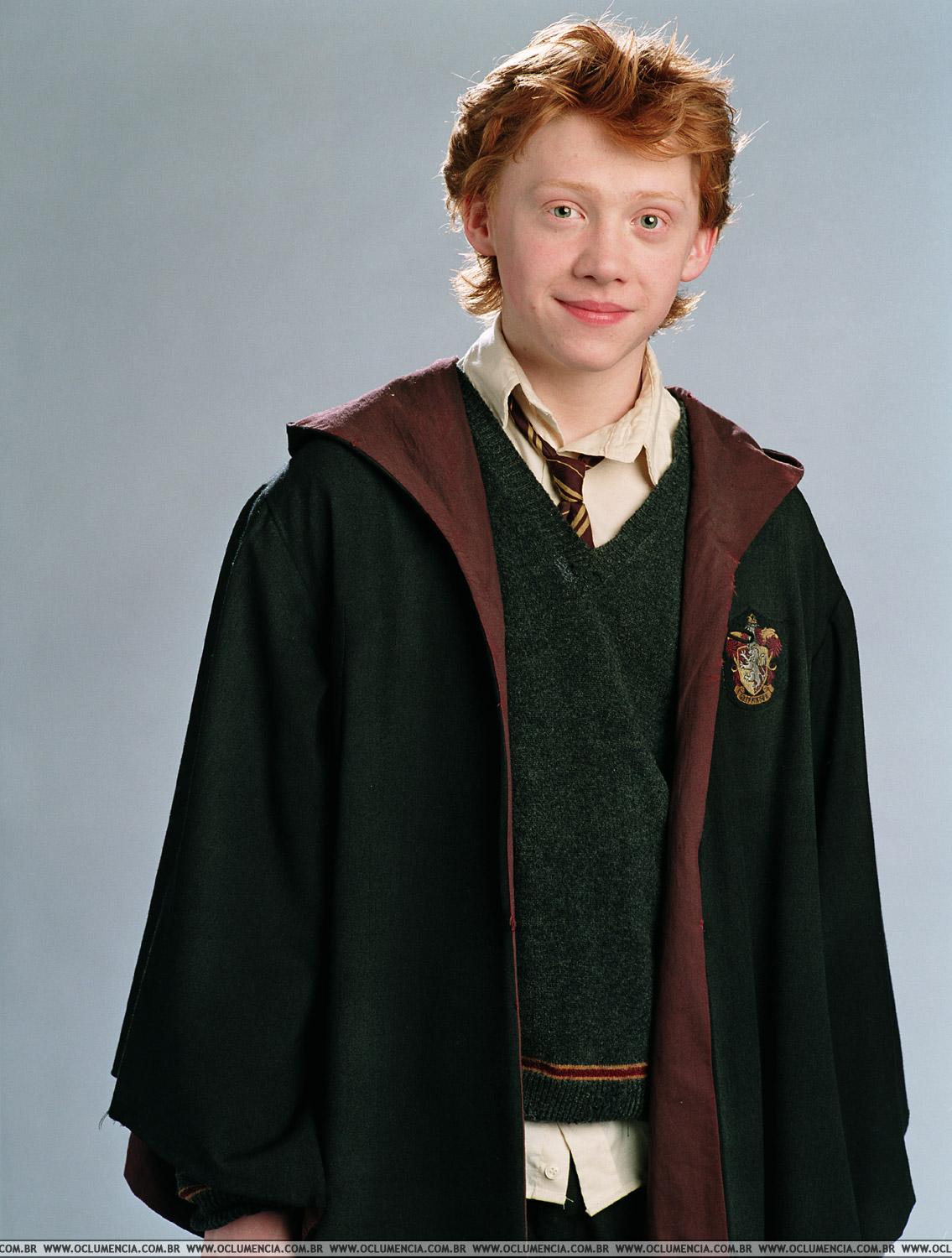

Ron Weasley Wallpapers - Top Free Ron Weasley Backgrounds - WallpaperAccess

Ron Weasley - Ronald Weasley Photo (30901215) - Fanpop